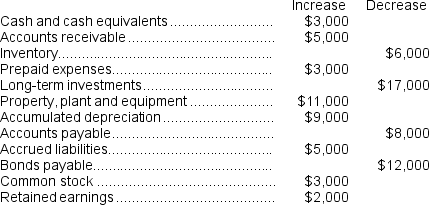

The changes in each balance sheet account for Carver Corporation during the year just completed are as follows:

Carver Corporation's income statement for the year just ended shows the following:

Carver Corporation's income statement for the year just ended shows the following:

The company did not dispose of any property,plant,and equipment,buy any long-term investments,issue any bonds payable,or repurchase any of its own common stock during the year.Carver Corporation uses the direct method to construct its statement of cash flows.

Required:

a.Determine the sales adjusted to the cash basis.

b.Determine the cost of goods sold adjusted to the cash basis.

c.Determine the selling and administrative expenses adjusted to a cash basis.

d.Determine the net cash provided by (used in)operating activities.

e.Determine the net cash provided by (used in)investing activities.

f.Determine the net cash provided by (used in)financing activities.

Definitions:

Opposition

Resistance or dissent, expressed in action or argument, against prevailing ideas, policies, or entities in power.

Martin Luther King

An American Baptist minister and activist who became the most visible spokesperson and leader in the civil rights movement from 1955 until his assassination in 1968.

Garbage Workers Strike

A labor strike involving sanitation workers who refuse to collect garbage, usually to protest for better wages, working conditions, or benefits.

Memphis

A city in the southwestern part of Tennessee, known for its influential strains of blues, soul, and rock 'n' roll music, as well as its historical significance in the civil rights movement.

Q3: Marks Corporation's balance sheet appears below:<br> <img

Q4: (Ignore income taxes in this problem.)You have

Q20: Kuma,Inc.had cost of goods sold of $106,000

Q43: The company's average collection period for Year

Q51: The company's net cash provided by (used

Q57: (Ignore income taxes in this problem.)Charlie Corporation

Q75: Cutsinger Corporation has provided the following

Q81: The net present value of the entire

Q147: Wood Carving Corporation manufactures three products.Because of

Q155: The simple rate of return would be