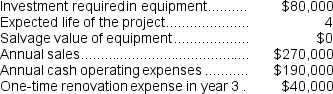

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Smaller Practices

Healthcare practices with a limited number of practitioners, offering more personalized care, often in a community setting.

Billing Time

The amount of time that professionals, such as lawyers or consultants, record for the purpose of charging their clients, often measured in increments of hours.

Payment Arrangement

An agreement between a patient and healthcare provider to pay for services over time rather than upfront.

Physician

A medical professional licensed to diagnose and treat illnesses, injuries, and other health conditions, often holding a Doctor of Medicine (MD) or Doctor of Osteopathic Medicine (DO) degree.

Q38: The net cash provided by (used in)operating

Q54: The net cash provided by (used in)operating

Q58: The sunk cost in this situation is:<br>A)

Q75: Perkins Corporation is considering several investment proposals,as

Q94: The Jabba Corporation manufactures the "Snack Buster"

Q95: (Ignore income taxes in this problem.)The management

Q110: Attal Corporation manufactures numerous products,one of which

Q145: The constraint at Dreyfus Inc.is an expensive

Q145: (Ignore income taxes in this problem.)Fossa Road

Q179: What is the financial advantage (disadvantage)of Alternative