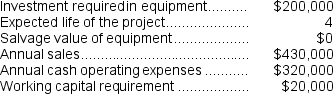

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Column

A vertical division in a table or spreadsheet that categorizes information under a specific heading.

Record

An individual entry in a database or dataset, representing a set of related data fields.

Record Source

The underlying data that provides the records for a form, report, or data-bound control in a database application.

Group And Sort

Features in database and spreadsheet software that allow users to organize data into categories and order them according to specific criteria, enhancing data analysis.

Q4: Free cash flow decreases when a company

Q7: The company's return on equity for Year

Q24: The net present value of Project B

Q30: Gehlhausen Corporation has provided the following financial

Q33: A balanced scorecard consists of a report

Q50: In the payback method,depreciation is added back

Q54: Eastwood Corporation manufactures numerous products,one of which

Q112: (Ignore income taxes in this problem.)The Zingstad

Q121: Mcelveen Corporation has provided the following information

Q158: A disadvantage of vertical integration is that