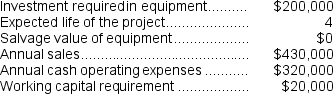

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Equity Method

An accounting technique used to record investments in which the investor has significant influence over the investee but does not control it outright.

Voting Shares

Shares that give the shareholder the right to vote on company matters, such as electing directors and approving company policies.

Purchase

The act of acquiring goods or services in exchange for money, signifying a transaction between two parties.

Share Issue

The process by which a company distributes its shares to investors, thereby raising capital.

Q10: "Cost-plus" pricing means that all costs--manufacturing,selling,and administrative--are

Q11: The amount of depreciation added to net

Q29: In a statement of cash flows,a change

Q63: Drew Cane Products,Inc.,processes sugar cane in batches.The

Q68: The net present value of the entire

Q79: The Cook Corporation has two divisions--East and

Q130: (Ignore income taxes in this problem)The management

Q138: The payback method is most appropriate for

Q160: Jepson Corporation's most recent income statement appears

Q277: Schepp Corporation has provided the following financial