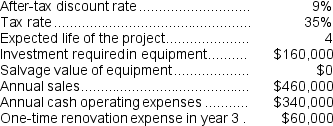

(Appendix 13C) Marbry Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Irregular Posture

A misalignment of the body's natural position, often causing discomfort or potential long-term health issues.

Neck And Shoulder Pain

Discomfort located in the structures of the neck or shoulder, often resulting from strain or overuse.

Overweight

Having more body fat than is optimally healthy, often defined as a Body Mass Index (BMI) over 25.

Back Pain

A common ailment affecting the lower, middle, or upper back, often caused by muscle strain, herniated discs, or spinal issues.

Q9: (Ignore income taxes in this problem.)Gallatin,Inc.,has assembled

Q11: On the statement of cash flows,the cost

Q18: Adah Corporation prepares its statement of cash

Q36: The net cash provided by (used in)investing

Q38: Last year the sales at Summit Corporation

Q50: In the payback method,depreciation is added back

Q90: Excerpts from Neuwirth Corporation's comparative balance sheet

Q138: The payback method is most appropriate for

Q159: (Ignore income taxes in this problem.)Laws Corporation

Q161: (Ignore income taxes in this problem.)Cardinal Pharmacy