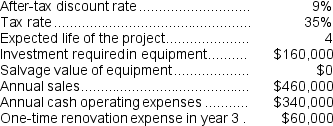

(Appendix 13C) Marbry Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Example

A specific case or instance used to illustrate or explain a concept, principle, or process.

Translation Limitations

The constraints and challenges faced during the process of translating text or speech from one language to another, often related to cultural nuances, idioms, and expressions.

Personal Space

The physical area surrounding an individual that is considered personal or private.

Body Language

Nonverbal cues expressed through physical behavior, such as gestures and posture, that communicate feelings and intentions.

Q13: What would be the financial advantage (disadvantage)from

Q17: The company's net cash provided by (used

Q45: The following transactions occurred last year at

Q58: The total cash flow net of income

Q65: The opportunity cost of making a component

Q80: The following transactions occurred last year at

Q91: In the statement of cash flows,collecting cash

Q140: In net present value analysis,an investment in

Q170: Kinsi Corporation manufactures five different products.All five

Q176: The most recent monthly income statement for