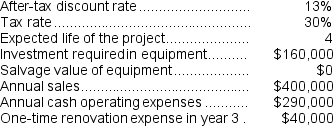

(Appendix 13C) Prudencio Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

AAA (Agricultural Adjustment Act)

A New Deal legislation passed in 1933 aimed at boosting agricultural prices by reducing surpluses through the payment of subsidies to farmers.

Sharecroppers

Individuals who farm land owned by another and pay rent either in cash or by sharing a portion of the produce.

Corporate Taxes

Taxes imposed on the income or profit of corporations and businesses by the government.

Nationalizing Industries

The process by which a government takes control of private industries and transforms them into state-owned enterprises.

Q16: (Ignore income taxes in this problem.)Suddeth Corporation

Q43: Degeare Corporation's balance sheet and income statement

Q46: Beacham Corporation's net cash provided by operating

Q51: The income tax expense in year 3

Q55: Ludy Mechanical Corporation has developed a new

Q61: If the formula for the markup percentage

Q118: Napp Heavy Machinery Corporation has developed a

Q161: (Ignore income taxes in this problem.)Cardinal Pharmacy

Q167: Selma Inc.reported the following results from last

Q184: How much of the unit product cost