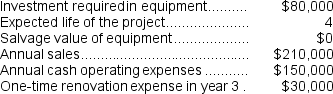

(Appendix 13C) Planas Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Independent Samples

Refers to two or more groups of samples that are selected from different populations, and each selection does not affect the other selections.

Automobile Insurance Appraisers

Professionals who assess the damage to vehicles involved in accidents to determine repair costs and liability for insurance claims.

Assessments

The evaluation or estimation of the nature, ability, or quality of something.

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, typically denoted as alpha.

Q41: The income tax expense in year 2

Q44: During the year the balance in the

Q52: (Ignore income taxes in this problem.)Crowl Corporation

Q69: When the internal rate of return method

Q90: Management is considering decreasing the price of

Q107: The simple rate of return focuses on

Q125: From a value-based pricing standpoint what is

Q145: (Ignore income taxes in this problem.)Fossa Road

Q146: The net present value of the entire

Q216: Perrett Corporation has provided the following financial