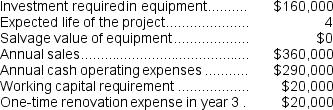

(Appendix 13C) Layer Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Family History Studies

Research methods that examine patterns of disorders or traits in families to identify genetic or environmental influences.

Biopsychosocial Methodology

An interdisciplinary approach that examines the complex interactions between biological, psychological, and social factors in health and illness.

Probands

Individuals who are the subject of study or the starting point in a genetic or medical investigation, often because they present with a particular condition of interest.

Single-Case Experimental Design

Experimental design in which an individual or a small number of individuals are studied intensively; the individual is put through some sort of manipulation or intervention, and his or her behavior is examined before and after this manipulation to determine the effects.

Q54: Rank the products in order of their

Q60: Under the indirect method of determining the

Q80: The following transactions occurred last year at

Q86: If the MCE is equal to 0.6,then

Q126: (Ignore income taxes in this problem.)Cannula Vending

Q136: (Ignore income taxes in this problem.)Congener Beverage

Q148: The minimum required rate of return is

Q154: Last year a company had sales of

Q194: What would be the financial advantage (disadvantage)from

Q276: Medina Corporation has provided the following financial