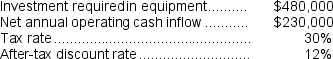

Condo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Voidable

A term describing a legal contract or action that may be nullified or terminated at the discretion of one or both parties involved.

Covenant Not to Compete

An agreement where one party agrees not to enter into or start a similar profession or trade in competition against another party.

Ongoing Business

A company or commercial enterprise that continues to operate and engage in its activities, as opposed to one that is in the process of closing down or has ceased operations.

Noncompetition

An agreement, often within a contract, that restricts one party from competing directly with another party, usually after termination of the agreement.

Q9: (Ignore income taxes in this problem.)A company

Q19: The total cash flow net of income

Q28: In a special order situation that involves

Q68: Paluso Corporation manufactures numerous products,one of which

Q69: The net present value of the entire

Q82: After introducing the product,the company finds that

Q90: Management is considering decreasing the price of

Q91: Hunt Company has the following production data:<br><img

Q113: The net present value method assumes that

Q120: If the company pursues the investment opportunity