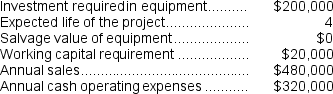

Falkowski Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $50,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35% and the after-tax discount rate is 8%.

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $50,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35% and the after-tax discount rate is 8%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Meeting Minutes

The written or recorded documentation of what was discussed and decided during a meeting, including actions taken or agreed upon.

Distributed Within

A term typically used to describe how resources, information, or responsibilities are spread across various parts or members within an organization or system.

Conflict Ignored

A situation where existing disagreements or problems are not addressed or resolved.

Meeting Progress

The advancement or development of topics and objectives during a scheduled gathering or conference.

Q29: Assume that dropping Product JYMP would result

Q36: The net cash provided by (used in)investing

Q43: Suppose there is ample idle capacity to

Q104: The total cash flow net of income

Q117: (Ignore income taxes in this problem.)Consider the

Q144: Part U67 is used in one of

Q147: Most of the opportunities to reduce the

Q154: According to the company's accounting system,what is

Q164: If the net present value of a

Q165: If management decides to buy part U98