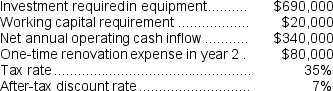

Patenaude Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Employees

Individuals who are hired to perform services or tasks for compensation under the direction and control of an employer.

Kingsley Davis

A notable sociologist and demographer who contributed to the study of population theory and urbanization.

Talented People

Individuals possessing a high degree of skill, ability, or natural aptitude, often in specific areas such as arts, sports, or academics.

Erik Olin Wright

A sociologist known for his work on social class, inequality, and alternatives to capitalism.

Q43: The desired profit according to the target

Q60: Under the indirect method of determining the

Q81: If the company pursues the investment opportunity

Q87: Haroldsen Corporation is considering a capital budgeting

Q103: Fixed costs are irrelevant in decisions about

Q106: Debona Corporation is considering a capital budgeting

Q106: Paying wages and salaries to employees is

Q110: Cash received from the sale of equipment

Q127: When a company pays a supplier for

Q197: What is the financial advantage (disadvantage)for the