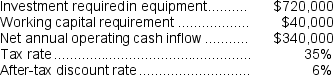

Padmore Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Absorption Costing

An accounting method that includes all manufacturing costs (direct materials, direct labor, and overhead) in the cost of a product.

Manufacturing Costs

The total expense incurred in the process of producing a product, which includes direct labor, direct materials, and overhead costs.

Gross Margin

Gross Margin is the difference between sales revenue and the cost of goods sold, expressed as a percentage of sales, indicating the efficiency of production and pricing.

Contribution Margin Income Statement

An income statement format that separates variable costs from fixed costs, focusing on contribution margin.

Q10: (Ignore income taxes in this problem.)Domebo Corporation

Q22: Maloney Corporation's balance sheet and income statement

Q28: The net present value of the entire

Q33: (Ignore income taxes in this problem.)Dowlen,Inc.,is considering

Q52: (Ignore income taxes in this problem.)Crowl Corporation

Q83: The income tax expense in year 3

Q110: The total cash flow net of income

Q114: Autry Corporation's balance sheet and income statement

Q117: (Ignore income taxes in this problem.)Consider the

Q194: What would be the financial advantage (disadvantage)from