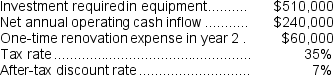

Hawthorn Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $170,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $170,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Independent Regulatory Agencies

Independent regulatory agencies are federal bodies created by Congress to enforce and regulate specific areas of economic activity, operating with some degree of independence from executive control.

Federal Communications Commission

A United States government agency that regulates interstate and international communications via radio, television, wire, satellite, and cable.

Executive Branch

The branch of government responsible for implementing and enforcing laws, usually led by a president or prime minister.

Administrative Law Judge

An official who presides over government agency hearings, making decisions on disputes, regulations, or rights.

Q7: The net cash provided by (used in)operating

Q14: Cabebe Corporation manufactures numerous products,one of which

Q20: Tennill Inc.has a $1,400,000 investment opportunity with

Q42: Infante Corporation has provided the following information

Q49: Return on investment (ROI)equals margin multiplied by

Q58: A manager would generally like to see

Q64: Ignoring the annual benefit,to the nearest whole

Q77: (Ignore income taxes in this problem.)Bradley Corporation's

Q120: (Ignore income taxes in this problem.)A company

Q141: Antinoro Corporation has provided the following information