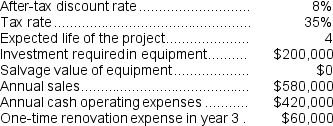

(Appendix 13C) Podratz Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

FIFO Periodic

An inventory valuation method where goods first purchased or produced are also the first to be sold, assessed periodically at the end of an accounting period.

Beginning Inventory

The value of a company's inventory at the start of an accounting period, used in calculating cost of goods sold during the period.

Inventory Value

The total cost or market value of all the goods held by a company that are ready or will be ready for sale.

FIFO Inventory

An accounting method where the first items added to inventory are the first ones considered sold.

Q13: (Ignore income taxes in this problem.)At an

Q25: Milford Corporation has in stock 16,100 kilograms

Q38: If machine hours are the constraint,then the

Q42: During the year the balance in the

Q127: Przewozman Corporation has provided the following information

Q131: From a value-based pricing standpoint what is

Q141: Minden Corporation estimates that the following costs

Q173: If Melbourne decides to purchase the subcomponent

Q178: (Ignore income taxes in this problem.)Jim Bingham

Q182: A customer has requested that Lewelling Corporation