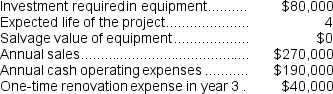

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Selling Price

The amount for which a product or service is sold to a customer.

Variable Costs

Costs that change in proportion to the level of production or business activity.

Cost Center

A department or unit within an organization to which costs can be allocated, but that does not directly generate revenue.

Performance Evaluation

The systematic process of assessing and reviewing an employee’s job performance and productivity in relation to established criteria and objectives.

Q12: In a statement of cash flows,which of

Q14: What is the financial advantage (disadvantage)for the

Q15: The internal rate of return of the

Q34: The net cash provided by (used in)operating

Q82: Porco Corporation is considering a capital budgeting

Q83: Which product makes the MOST profitable use

Q87: Haroldsen Corporation is considering a capital budgeting

Q148: The minimum required rate of return is

Q157: (Ignore income taxes in this problem.)Ramson Corporation

Q174: Part U16 is used by Mcvean Corporation