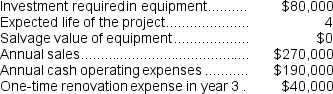

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Equilibrium Quantity

The quantity of a good or service at which quantity demanded equals quantity supplied, leading to a stable market condition.

Producer Surplus

The disparity between the price at which sellers are ready to offer a product and the price they actually get.

Price Floor

A government-imposed limit below which prices cannot fall, typically used to ensure that producers can cover their costs.

Market Price

The current price at which an asset or service can be bought or sold in a particular market.

Q3: The net present value of the entire

Q7: The net cash provided by (used in)operating

Q30: An increase in accounts receivable of $1,000

Q56: Cirillo Corporation is considering a capital budgeting

Q70: Rank the projects according to the profitability

Q74: (Ignore income taxes in this problem.)Orbit Airlines

Q76: Magney,Inc.,uses the absorption costing approach to cost-plus

Q107: The company's gross margin percentage for Year

Q140: In net present value analysis,an investment in

Q207: Moselle Corporation has provided the following financial