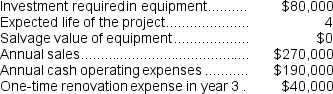

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Data Processing

The collection and manipulation of data to produce meaningful information.

Cost Accounting

An accounting method focused on capturing a company's total costs of production by assessing both fixed and variable costs.

Capital Expenditures

Funds used by a company to acquire or upgrade physical assets such as property, industrial buildings, or equipment to improve its long-term productivity and efficiency.

Financial Planning

The process of creating strategies for managing financial affairs, including budgeting, investing, and retirement preparation, to achieve one’s financial goals.

Q14: (Ignore income taxes in this problem.)Given the

Q33: The net cash provided by (used in)financing

Q47: A customer has asked Lalka Corporation to

Q48: Under the direct method,sales adjusted to a

Q55: Ludy Mechanical Corporation has developed a new

Q91: If the new product is added next

Q110: The total cash flow net of income

Q112: Assume that the total traceable fixed expense

Q119: Coache Corporation is considering a capital budgeting

Q129: Morefield Corporation has provided the following information