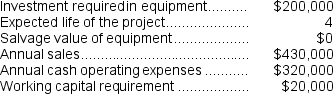

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Q3: Assume that the total traceable fixed expense

Q43: (Ignore income taxes in this problem.)The management

Q46: The company has received a special,one-time-only order

Q80: Patenaude Corporation has provided the following information

Q90: Excerpts from Neuwirth Corporation's comparative balance sheet

Q93: Land held for possible plant expansion would

Q130: Variable costs are always relevant costs in

Q164: Mcniff Corporation makes a range of products.The

Q164: If the net present value of a

Q169: What is the financial advantage (disadvantage)for the