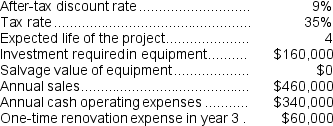

(Appendix 13C) Marbry Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Equipment

Tangible items used in the operation or production process of a business.

Financial Statement

A documented summary detailing a company's business operations and financial health, usually encompassing the balance sheet, income statement, and statement of cash flows.

Total

The sum or aggregate amount resulting from the addition of individual items or elements in a set.

Credit Purchase

Buying goods or services and deferring payment to a later date, typically recorded as accounts payable.

Q3: The changes in each balance sheet

Q24: The net present value of Project B

Q24: Mounger Industrial Products Inc.has developed a new

Q39: Last year Cumberland Corporation reported a cost

Q44: Supler Corporation produces a part used in

Q54: Eastwood Corporation manufactures numerous products,one of which

Q90: Excerpts from Neuwirth Corporation's comparative balance sheet

Q90: Product U23N has been considered a drag

Q116: The statement of cash flows relies on

Q128: The project profitability index and the internal