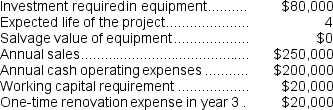

(Appendix 13C) Mulford Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Competitive Parity Method

A budgeting strategy in marketing where a company allocates budget based on competitors' spending to maintain parity or competitiveness in the market.

Objective And Task Method

A budgeting method in marketing where objectives are set first, and then the tasks needed to achieve these objectives are determined.

Center of Excellence Model

A dedicated team or entity that provides leadership, best practices, research, support, and training for a specific focus area or domain within an organization.

Silo Model

An organizational structure that segregates different departments or units, limiting communication and collaboration between them.

Q15: The higher the discount rate,the higher the

Q20: Which product makes the LEAST profitable use

Q21: From a value-based pricing standpoint what is

Q22: Maloney Corporation's balance sheet and income statement

Q30: The net present value of the overhaul

Q49: Carr Corporation's comparative balance sheet and income

Q50: Based solely on the information above,the net

Q65: (Ignore income taxes in this problem.)In an

Q76: Magney,Inc.,uses the absorption costing approach to cost-plus

Q78: Cash equivalents on the statement of cash