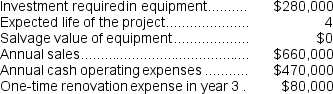

(Appendix 13C) Paletta Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Carrying Amount

The net value of an asset or liability according to a company’s financial statements, calculated as the original cost minus any depreciation, amortization, or impairment costs.

Supplies Account

An account used to track the cost of supplies consumed during a period or the supplies on hand at the end of a period.

Adjusting Entry

A journal entry made at the end of an accounting period to update the ledger for revenues and expenses that have been earned or incurred but not yet recorded.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset, reducing its carrying value on the balance sheet over time.

Q6: (Ignore income taxes in this problem.)In order

Q9: (Ignore income taxes in this problem.)Gallatin,Inc.,has assembled

Q14: What is the financial advantage (disadvantage)for the

Q21: From a value-based pricing standpoint what is

Q22: If improvement in a performance measure on

Q25: Milford Corporation has in stock 16,100 kilograms

Q68: The company's net cash provided by (used

Q100: In target costing,the cost of a product

Q109: From a value-based pricing standpoint what is

Q171: One way to increase the effective utilization