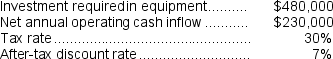

Rapozo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Treasury Stock Approach

A method of accounting for repurchased shares of a company's own stock, treating them as treasury stock and reducing the company's equity.

Noncontrolling Interest

The portion of equity in a subsidiary not attributable to the parent company, representing outside investors' ownership.

Net Income

The total earnings of a company after subtracting all expenses from revenue.

Goodwill

The value attributed to a company's brand name, customer base, customer relations, employee relations, and patents or proprietary technology.

Q22: Maloney Corporation's balance sheet and income statement

Q29: Carson Corporation's comparative balance sheet and

Q59: Tallon Inc.has a $1,200,000 investment opportunity that

Q66: The markup over cost under the absorption

Q72: (Ignore income taxes in this problem.)Denny Corporation

Q87: If the balanced scorecard is correctly constructed,the

Q102: (Ignore income taxes in this problem.)Ducey Corporation

Q148: It is profitable to continue processing joint

Q156: Assume Melville anticipates selling only 50,000 units

Q197: What is the financial advantage (disadvantage)for the