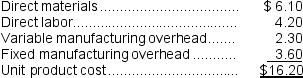

Gallerani Corporation has received a request for a special order of 6,000 units of product A90 for $21.20 each.Product A90's unit product cost is $16.20,determined as follows: Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Assume that direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product A90 that would increase the variable costs by $4.20 per unit and that would require an investment of $21,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Dividend Increases

Instances where a company raises the amount of money it pays to its stockholders in dividends.

Market Rate

The prevailing interest rate or cost of borrowing in the financial markets at any given time.

Annual Dividend

A yearly payment made by a corporation to its shareholders, usually derived from profits.

Total Return

Total return is the full return on an investment over a given period, including all dividends, interest, and capital gains, adjusted for any capital losses.

Q12: Hennig Plastics Equipment Corporation has developed a

Q32: Quamma Corporation makes a product that has

Q47: Familia Inc.reported the following results from last

Q52: The markup percentage on the new product

Q61: What is the financial advantage (disadvantage)of Alternative

Q63: Hammen Corporation manufactures numerous products,one of which

Q67: (Ignore income taxes in this problem.)Anthony operates

Q72: Mattix Corporation's balance sheet and income statement

Q128: Chiodini Inc.has a $900,000 investment opportunity that

Q184: How much of the unit product cost