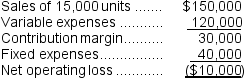

The Draper Corporation is considering dropping its Doombug toy due to continuing losses. Data on the toy for the past year follow:

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.

-Suppose that if the Doombug toy is dropped,the production and sale of other Draper toys would increase so as to generate a $16,000 increase in the contribution margin received from these other toys.If all other conditions are the same,the financial advantage (disadvantage) from discontinuing the production and sale of Doombugs would be:

Definitions:

Warehouse Space

A designated area used for storing goods in order to ensure their preservation, organization, or security before distribution.

Perfectly Competitive Industry

An industry structure where many firms produce identical products, entry and exit are easy, and no single firm can influence the market price.

Demand Curve

A graph showing the relationship between the price of a good and the quantity demanded, with a typical downward slope indicating that demand increases as price decreases.

Producer's Surplus

The difference between what producers are willing to accept for a good or service and what they actually receive.

Q16: For performance evaluation purposes,how much of the

Q19: What is the financial advantage (disadvantage)for the

Q19: The total cash flow net of income

Q41: (Ignore income taxes in this problem.)An expansion

Q54: The net present value of the entire

Q61: The combined present value of the working

Q81: Rohrer Products,Inc.,has a Motor Division that manufactures

Q97: The income tax expense in year 2

Q152: Swagger Corporation purchases potatoes from farmers.The potatoes

Q171: Lumsden Inc.has a $1,200,000 investment opportunity with