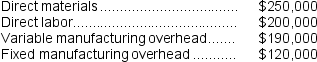

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

-If Melbourne decides to purchase the subcomponent from the outside supplier,the annual financial advantage (disadvantage) would be:

Definitions:

Continuous

Without interruption or end, often used to describe processes or events that persist over time without stopping.

Cephalocaudal

A principle of growth and development where development proceeds from the head downwards through the body.

Proximodistal

A pattern of growth and development where development proceeds from the center of the body outward towards the extremities.

Infant's Head

The upper part of a baby's body that contains the brain, eyes, ears, nose, and mouth, crucial for early sensory and cognitive development.

Q3: The present value of a cash flow

Q29: Assume that dropping Product JYMP would result

Q39: The income tax expense in year 2

Q100: Lennox Corporation has provided the following information

Q125: (Ignore income taxes in this problem.)Boxton Corporation's

Q132: Anguiano Inc.reported the following results from last

Q153: The division's residual income is closest to:<br>A)

Q165: If management decides to buy part U98

Q167: (Ignore income taxes in this problem.)Olinick Corporation

Q176: The most recent monthly income statement for