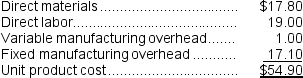

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 70,000 units required each year?

Definitions:

Women Owning Business

Refers to enterprises that are majority-owned by women, showcasing gender diversity in entrepreneurship.

Hispanic-Owned Businesses

Enterprises owned and operated by individuals of Hispanic heritage, contributing to the economic diversity and development.

Annual Revenue

The total amount of income generated by a company from its activities over a year before any costs or expenses are deducted.

Crediting Purposes

The act of acknowledging someone's contribution or work, often for the purpose of assigning merit or recognition.

Q20: Which product makes the LEAST profitable use

Q26: When a dispute arises over a transfer

Q32: On the statement of cash flows,the income

Q83: If the present bus is repaired,the present

Q91: Bratton Corporation has provided the following information

Q135: Priddy Corporation processes sugar cane in batches.The

Q138: Secore Robotics Corporation has developed a new

Q151: (Ignore income taxes in this problem.)Heap Corporation

Q157: (Ignore income taxes in this problem.)Ramson Corporation

Q167: (Ignore income taxes in this problem.)Olinick Corporation