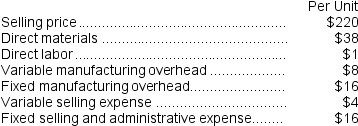

Younes Inc. manufactures industrial components. One of its products, which is used in the construction of industrial air conditioners, is known as P06. Data concerning this product are given below:

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

The above per unit data are based on annual production of 4,000 units of the component. Assume that direct labor is a variable cost.

-The company has received a special,one-time-only order for 400 units of component P06.There would be no variable selling expense on this special order and the total fixed manufacturing overhead and fixed selling and administrative expenses of the company would not be affected by the order.Assuming that Younes has excess capacity and can fill the order without cutting back on the production of any product,what is the minimum price per unit below which the company should not accept the special order?

Definitions:

Q9: (Ignore income taxes in this problem.)Gallatin,Inc.,has assembled

Q16: Timdat Corporation,a manufacturer of moderate-priced time pieces,would

Q18: The selling price would be closest to:<br>A)

Q45: Opportunity costs represent costs that can be

Q54: Digby Corporation's balance sheet and income statement

Q65: The opportunity cost of making a component

Q83: The income tax expense in year 3

Q85: What is the maximum price that the

Q133: Bungert Inc.reported the following results from last

Q145: Last year's return on investment (ROI)was closest