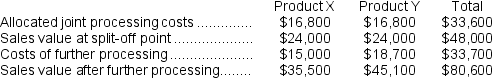

Dock Corporation makes two products from a common input. Joint processing costs up to the split-off point total $33,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

-What is the financial advantage (disadvantage) for the company of processing Product X beyond the split-off point?

Definitions:

Year 1

Refers to the first year of operation for a business or the first year of a specific reporting period.

Contra-asset

A contra-asset account is a type of asset account where its balance is a negative figure that offsets the balance of its corresponding asset account.

Liability

A financial obligation or debt owed by a company to another entity, which is expected to be settled through the transfer of assets or services.

Inventory

Consists of all the goods a company has in stock that are ready to be sold, including raw materials, work-in-progress, and finished goods.

Q14: All charges for services computed using budgeted

Q16: The net present value of the new

Q18: Moates Corporation has provided the following data

Q34: (Ignore income taxes in this problem.)An investment

Q40: Vore Corporation is considering a capital budgeting

Q45: Opportunity costs represent costs that can be

Q85: Which of the following would be considered

Q128: What is the financial advantage (disadvantage)to the

Q148: It is profitable to continue processing joint

Q153: The division's residual income is closest to:<br>A)