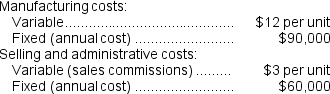

Marsdon Company has an annual production capacity of 15,000 units.The costs associated with production and sale of the company's product are given below:

The company presently is selling 12,000 units annually at a selling price of $28 each.A special order has been received from a distributor who wants to purchase 3,000 units at a special price of $20 each.Regular sales would not be affected by this order and the order could be filled without any impact on total fixed costs.Sales commissions on the special order would be reduced by one-third.

The company presently is selling 12,000 units annually at a selling price of $28 each.A special order has been received from a distributor who wants to purchase 3,000 units at a special price of $20 each.Regular sales would not be affected by this order and the order could be filled without any impact on total fixed costs.Sales commissions on the special order would be reduced by one-third.

Required:

Determine whether the company should accept the special order.

Definitions:

Expropriation

The act of a government seizing privately owned property, often without fair compensation, for public use or in the interest of the public.

Political Entity

Refers to any organization that holds a set of political powers and responsibilities, such as a nation, state, or government.

Sovereignty

The supreme authority within a territory, allowing it to govern itself or make decisions independently.

Inflation Rate

The rate at which the general level of prices for goods and services rises, eroding purchasing power.

Q7: A vertically integrated company is less dependent

Q9: (Ignore income taxes in this problem.)A company

Q20: Variable selling and administrative costs are excluded

Q52: The markup percentage on the new product

Q56: The target costing approach was developed in

Q64: Ignoring the annual benefit,to the nearest whole

Q76: Magney,Inc.,uses the absorption costing approach to cost-plus

Q80: Patenaude Corporation has provided the following information

Q97: Whenever the selling division must give up

Q112: (Ignore income taxes in this problem.)The Zingstad