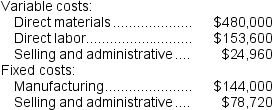

Kneller Co.manufactures and sells medals for winners of athletic and other events.Its manufacturing plant has the capacity to produce 12,000 medals each month; current monthly production is 9,600 medals.The company normally charges $99 per medal.Cost data for the current level of production are shown below:

The company has just received a special one-time order for 500 medals at $89 each.For this particular order,no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

The company has just received a special one-time order for 500 medals at $89 each.For this particular order,no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

Required:

Should the company accept this special order? Why?

Definitions:

Voting Shares

Shares that give the shareholder the right to vote on matters of corporate policy and the election of the board of directors.

Carrying Value

The book value of an asset on a company’s balance sheet, calculated as its original cost minus accumulated depreciation or amortization.

Voting Shares

Another term for voting equity interests, specifically referring to shares that allow the shareholder to vote on corporate decisions.

Non-Operating Sources

Revenue or income that arises from activities not related to a company’s core business operations.

Q9: (Ignore income taxes in this problem.)Gallatin,Inc.,has assembled

Q20: Tabarez Corporation's Maintenance Department provides services to

Q24: The net present value of Project B

Q40: Leslie Company operates a cafeteria for the

Q52: Gottshall Inc.makes a range of products.The company's

Q57: (Ignore income taxes in this problem.)Charlie Corporation

Q85: Colantro Corporation has provided the following information

Q129: Morefield Corporation has provided the following information

Q160: Schlarbaum Corporation's management keeps track of the

Q165: If the residual income for the year