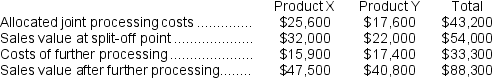

Ibsen Company makes two products from a common input.Joint processing costs up to the split-off point total $43,200 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:

Required:

Required:

a.What is financial advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is financial advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Business Strategy

A plan of action designed by an organization to achieve specific goals, outperform competition, and secure long-term success.

Ubiquitin

A small eukaryotic regulatory polypeptide that can be covalently bonded to proteins, targeting the protein for destruction and recycling. Also used to regulate protein activities.

Repressor Proteins

Proteins that bind to specific sequences of DNA to inhibit the transcription of genes, playing a critical role in gene regulation.

Transcription

The method through which the data contained in a DNA strand is replicated into a fresh molecule of messenger RNA (mRNA).

Q22: The Parts Division of Nydron Corporation makes

Q29: For performance evaluation purposes,how much of the

Q42: Gauani Products,Inc.,has a Detector Division that manufactures

Q45: (Ignore income taxes in this problem.)Bau Long-Haul,Inc.,is

Q62: Siegrist Products,Inc.,has a Pump Division that manufactures

Q112: Assume that the total traceable fixed expense

Q118: Basta Corporation has provided the following data

Q130: (Ignore income taxes in this problem)The management

Q149: Cogdill Corporation manufactures numerous products,one of which

Q159: All other things the same,an increase in