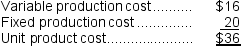

Sharp Corporation produces 8,000 parts each year,which are used in the production of one of its products.The unit product cost of a part is $36,computed as follows: The parts can be purchased from an outside supplier for only $28 each.The space in which the parts are now produced would be idle and fixed production costs would be reduced by one-fourth.Based on these data,the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

The parts can be purchased from an outside supplier for only $28 each.The space in which the parts are now produced would be idle and fixed production costs would be reduced by one-fourth.Based on these data,the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

Definitions:

Socially Optimal Price

This is the price point at which the social benefits of product consumption match the overall cost of production, aiming for an efficient allocation of resources.

Natural Monopoly

A type of monopoly that exists due to the high fixed or startup costs of operating a business in a specific industry, making it inefficient for more than one firm to operate.

Marginal Cost

The increase in cost resulting from the production of one additional unit of a product.

Demand Curve

A graphical illustration that demonstrates the link between the cost of an item and how much of it consumers are willing to buy.

Q12: The present value of a given future

Q19: The Clipper Corporation had net operating income

Q20: The total cash flow net of income

Q22: Erholm Corporation has two operating divisions--an Atlantic

Q26: Demand for a product is said to

Q51: Beery Inc.reported the following results from last

Q51: (Ignore income taxes in this problem.)Jark Corporation

Q55: Suppose that if the Doombug toy is

Q64: The division's turnover is closest to:<br>A) 13.16<br>B)

Q74: The income tax expense in year 3