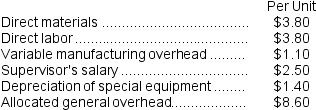

Rebelo Corporation is presently making part E07 that is used in one of its products.A total of 17,000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity: An outside supplier has offered to make and sell the part to the company for $20.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company,none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part E07 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to make and sell the part to the company for $20.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company,none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part E07 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

Definitions:

Average Total Cost

The total cost of production divided by the quantity produced, representing the average cost per unit.

Short Run

A period in economics where at least one factor of production is fixed and cannot be changed.

Purely Competitive

A market structure characterized by many sellers offering identical products with no single seller able to influence the market price.

Total Revenue

The total amount of money a firm receives from sales of its products or services before any expenses are subtracted.

Q5: Saulsberry Corporation manufactures numerous products,one of which

Q9: The total cash flow net of income

Q18: Moates Corporation has provided the following data

Q20: Variable selling and administrative costs are excluded

Q75: The division's turnover is closest to:<br>A) 3.26<br>B)

Q79: What is the delivery cycle time?<br>A) 4

Q99: Foto Company makes 50,000 units per year

Q120: (Ignore income taxes in this problem.)A company

Q146: Which of the following would not be

Q149: The basic objective of responsibility accounting is