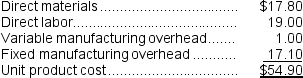

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the financial advantage (disadvantage) of purchasing the part rather than making it?

Definitions:

Anonymous Questionnaire

A survey or form designed to gather information anonymously, ensuring the privacy and confidentiality of respondents.

Female Sexual Harassment

Unwelcome sexual advances, requests for sexual favors, and other verbal or physical harassment of a sexual nature targeted towards females.

Survey

A survey is a research method used for collecting data from a predefined group of respondents to gain information and insights on various topics of interest.

Double-Blind Control

A study or experiment design in which neither the participants nor the experimenters know who is receiving a particular treatment, to prevent bias.

Q17: The ROI for the investment opportunity is

Q29: Assume that dropping Product JYMP would result

Q43: Inocencio Corporation has provided the following information

Q57: Marsdon Company has an annual production capacity

Q68: The net present value of the entire

Q86: Byerly Corporation has provided the following data

Q112: Craycraft Inc.reported the following results from last

Q132: Truskowski Corporation has provided the following information

Q140: Alghamdi Corporation keeps careful track of the

Q160: (Ignore income taxes in this problem.)A company