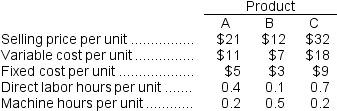

The Wester Corporation produces three products with the following costs and selling prices:

The company has insufficient capacity to fulfill all of the demand for these three products.

The company has insufficient capacity to fulfill all of the demand for these three products.

-If direct labor hours are the constraint,then the ranking of the products from the most profitable to the least profitable use of the constrained resource is:

Definitions:

LIFO Periodic

An inventory valuation method, Last In First Out, used in periodic inventory systems where the last items added to the inventory are assumed to be sold first.

Perpetual LIFO

Perpetual LIFO, or Last-In, First-Out, is an inventory accounting method continuously updating inventory and costs of goods sold by assuming the last items purchased are the first to be sold.

Ending Inventory

The worth of products ready for purchase at the conclusion of a financial period.

Cost Flow Assumption

A method adopted by businesses to value inventory and determine the cost of goods sold, such as FIFO (First In, First Out) or LIFO (Last In, First Out).

Q8: Suppose an investment has cash inflows of

Q79: If outside customers demand 70,000 units,then according

Q79: Bellini Robotics Corporation has developed a new

Q82: Porco Corporation is considering a capital budgeting

Q103: Fixed costs are irrelevant in decisions about

Q103: Residual income should be used to evaluate

Q113: The net present value method assumes that

Q160: (Ignore income taxes in this problem.)A company

Q165: If the residual income for the year

Q172: (Ignore income taxes in this problem)The management