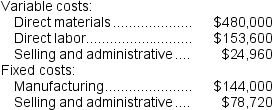

Kneller Co.manufactures and sells medals for winners of athletic and other events.Its manufacturing plant has the capacity to produce 12,000 medals each month; current monthly production is 9,600 medals.The company normally charges $99 per medal.Cost data for the current level of production are shown below:

The company has just received a special one-time order for 500 medals at $89 each.For this particular order,no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

The company has just received a special one-time order for 500 medals at $89 each.For this particular order,no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

Required:

Should the company accept this special order? Why?

Definitions:

Net Sales

The amount of revenue generated from sales activities after returns, allowances, and discounts have been subtracted.

Operating Expenses

Operating expenses are the costs associated with running a business’s core activities on a day-to-day basis, excluding the cost of goods sold.

Sales Revenue

The total amount earned by a company from its sales of goods or services, before any deductions for returned goods and allowances.

Gross Profit Rate

A financial ratio that compares gross profit to net sales, indicating the efficiency of production and pricing.

Q1: The net present value of the proposed

Q76: The book value of an old machine

Q86: Assume that the Valve Division is selling

Q86: If the MCE is equal to 0.6,then

Q87: The Wyeth Corporation produces three products,A,B,and C,from

Q91: Hunt Company has the following production data:<br><img

Q120: Are the materials costs and processing costs

Q125: Petro Corporation has provided the following information

Q178: The ROI for this year's investment opportunity

Q192: If Elly Industries continues to use 30,000