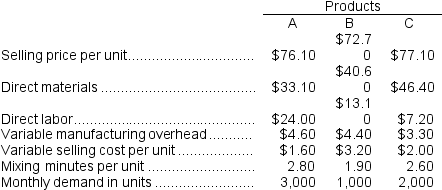

Holton Company makes three products in a single facility.Data concerning these products follow:

The mixing machines are potentially the constraint in the production facility.A total of 14,700 minutes are available per month on these machines.

The mixing machines are potentially the constraint in the production facility.A total of 14,700 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

Required:

a.How many minutes of mixing machine time would be required to satisfy demand for all three products?

b.How much of each product should be produced to maximize net operating income? (Round off to the nearest whole unit.)

c.Up to how much should the company be willing to pay for one additional hour of mixing machine time if the company has made the best use of the existing mixing machine capacity? (Round off to the nearest whole cent.)

Definitions:

Absorption Costing

An accounting approach that includes all manufacturing costs (both variable and fixed) in the cost of a product, used for external reporting.

Plantwide Overhead Rate

A single overhead rate calculated by dividing total factory overhead by the total amount of the allocation base used across the entire plant.

Direct Labor

Labor costs associated with employees who are directly involved in the production of goods or the provision of services.

Predetermined Overhead Rate

A rate used to assign overhead costs to products or services, calculated by dividing estimated overhead by an allocation base such as labor hours.

Q2: ROI and residual income are tools used

Q9: Assume that Bharu is manufacturing and selling

Q37: The net present value of the proposed

Q45: Opportunity costs represent costs that can be

Q46: The selling price based on the absorption

Q65: When used in return on investment (ROI)calculations,turnover

Q66: What is the financial advantage (disadvantage)for the

Q69: Cybil Baunt just inherited a 1958 Chevy

Q93: The following information concerning a proposed capital

Q104: Ibsen Company makes two products from a