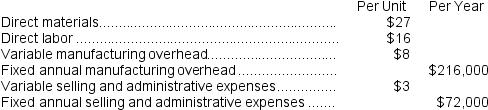

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

-The selling price would be closest to:

Definitions:

Q14: Starcic Products,Inc.,has a Connector Division that manufactures

Q41: Cannata Corporation has two operating divisions--a North

Q57: Marsdon Company has an annual production capacity

Q61: What is the financial advantage (disadvantage)of Alternative

Q64: Mittan Products,Inc.,has a Antennae Division that manufactures

Q75: Seamons Corporation has the following information available

Q89: Meers Products,Inc.,has a Detector Division that manufactures

Q122: Are the materials costs and processing costs

Q128: All cash inflows are taxable.

Q156: The standard price per unit for direct