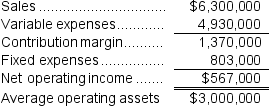

Robichau Inc. reported the following results from last year's operations:

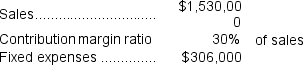

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 20%.

The company's minimum required rate of return is 20%.

-The ROI for this year's investment opportunity considered alone is closest to:

Definitions:

Market Value

The price at which an asset would trade in a competitive auction setting, reflecting its value to buyers and sellers.

Accounting Gain

A financial benefit that results from selling an asset at a price higher than its book value, recognized in the financial statements of a company.

Book Value

The value of an asset according to its balance sheet account balance, taking into account the cost of the asset less any depreciation, amortization, or impairment costs.

Futures Contracts

Standardized legal agreements to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future.

Q17: The ROI for the investment opportunity is

Q20: Variable selling and administrative costs are excluded

Q23: The division's turnover is closest to:<br>A) 3.40<br>B)

Q40: When recording the raw materials purchases in

Q72: Hill Corporation is contemplating the introduction of

Q106: Aboud Industrial Products Inc.has developed a new

Q112: Fixed costs may be relevant in a

Q129: Lemke Corporation uses a standard cost system

Q143: Acri Corporation manufactures numerous products,one of which

Q199: The standard quantity or standard hours allowed