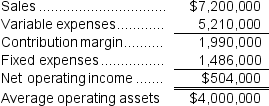

Wolley Inc.reported the following results from last year's operations:

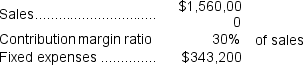

At the beginning of this year,the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year,the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year,would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Definitions:

Mass Producer

A mass producer is a company or individual that manufactures goods in large quantities using standardized processes, usually to meet widespread consumer demand.

Productivity

A measure of the efficiency of production, often quantified as the ratio of output to inputs used in the production process.

Wage Rates

The standard amount of compensation given to employees for their services, usually expressed per hour or year.

Global Economy

The interconnected worldwide economic activities that involve the exchange of goods and services across national borders.

Q16: When the purchase of raw materials is

Q16: The variable overhead rate variance for the

Q21: For performance evaluation purposes,the actual fixed costs

Q24: The residual income for the Hum Division

Q25: Levar Corporation has two operating divisions--a Consumer

Q38: Schapp Corporation keeps careful track of the

Q75: The division's turnover is closest to:<br>A) 3.26<br>B)

Q89: Highfill Corporation's variable overhead is applied on

Q115: BR Company has a contribution margin of

Q138: Which of the following segment performance measures