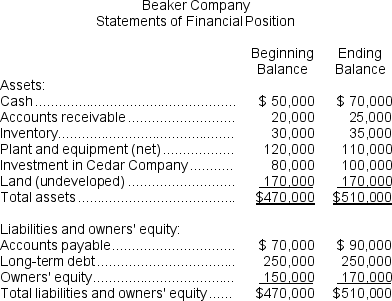

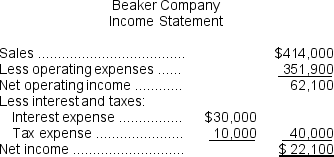

Financial data for Beaker Company for last year appear below:

The company paid dividends of $2,100 last year.The "Investment in Cedar Company" on the statement of financial position represents an investment in the stock of another company.

The company paid dividends of $2,100 last year.The "Investment in Cedar Company" on the statement of financial position represents an investment in the stock of another company.

Required:

a.Compute the company's margin,turnover,and return on investment for last year.

b.The Board of Directors of Beaker Company has set a minimum required return of 20%.What was the company's residual income last year?

Definitions:

Unique Risk

Referred to as unsystematic risk, it denotes the risk linked to a particular company or sector.

Firm-specific Risk

Risk associated with an individual company, as opposed to the market as a whole.

Efficient Frontier

A graphical representation in portfolio management that shows the best possible investment portfolios that offer the highest expected return for a given level of risk.

Risky Assets

Assets that have a higher degree of uncertainty in their returns, often with the potential for higher gains but also higher losses.

Q42: A joint product is:<br>A) any product which

Q62: Juliani Company produces a single product.The cost

Q77: If outside customers demand 80,000 units and

Q79: The Cook Corporation has two divisions--East and

Q138: The standard number of machine-hours allowed for

Q145: Last year's return on investment (ROI)was closest

Q162: The raw materials price variance for the

Q166: Bowen Company produces products P,Q,and R from

Q181: Assume the company has 50 units left

Q236: The standards for product G78V specify 4.1