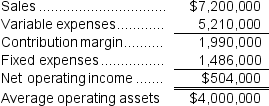

Wolley Inc.reported the following results from last year's operations:

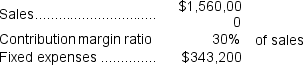

At the beginning of this year,the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year,the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year,would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Definitions:

Time-Weighted Return

A method to measure the rate of return of an investment portfolio which eliminates the distorting effects of inflows and outflows of money.

Dividend

Dividend represents the distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders.

Share

A unit of ownership in a company or financial asset, often traded on a stock exchange.

Arithmetic Average Return

The simple average of a series of returns over a period of time, calculated by summing the returns and dividing by the number of periods.

Q34: How much actual Maintenance Department cost should

Q66: What is the financial advantage (disadvantage)for the

Q70: Godina Products,Inc.,has a Receiver Division that manufactures

Q73: From a value-based pricing standpoint what is

Q74: A study has been conducted to determine

Q81: The materials quantity variance for September is:<br>A)

Q88: Management is considering increasing the price of

Q97: If the company pursues the investment opportunity

Q101: The labor rate variance for May is:<br>A)

Q136: Juliano Corporation uses a standard cost system