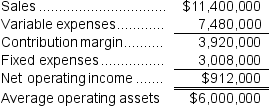

Ranallo Inc.reported the following results from last year's operations:

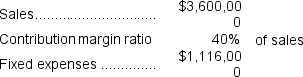

At the beginning of this year,the company has a $1,800,000 investment opportunity with the following characteristics:

At the beginning of this year,the company has a $1,800,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year,would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

11.What was last year's residual income?

12.What is the residual income of this year's investment opportunity?

13.If the company pursues the investment opportunity and otherwise performs the same as last year,what will be the overall residual income this year?

14.If Westerville's CEO earns a bonus only if residual income for this year exceeds residual income for last year,would the CEO pursue the investment opportunity?

Definitions:

Q7: Inscho Corporation manufactures numerous products,one of which

Q26: Amirault Manufacturing Corporation has a standard cost

Q27: For performance evaluation purposes,the fixed costs of

Q45: The net operating income for Year 1

Q64: When recording the raw materials used in

Q70: The labor efficiency variance for the month

Q73: Liapis Products,Inc.,has a Valve Division that manufactures

Q91: Nanke Products,Inc.,has a Sensor Division that manufactures

Q137: Up to how much should the company

Q198: Motts Inc.has a standard cost system in