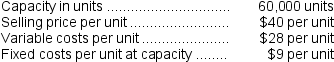

(Appendix 11A) Division A of Tripper Company produces a part that it sells to other companies. Sales and cost data for the part follow:

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

Division B, another division of Tripper Company, would like to buy this part from Division A. Division B is presently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.

-Assume that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into outside sales.According to the formula in the text,what is the lowest acceptable transfer price from the viewpoint of the selling division?

Definitions:

Cost Per Unit

The total cost to produce a single unit of product, including fixed and variable costs.

Fixed Costs

Costs that do not change with the level of output or production, such as rent, salaries, and insurance premiums.

Level Of Activity

A measure of the volume of production or operations within a business, used to allocate costs or plan for capacities.

Direct Labor Cost

The total expense incurred by a company for the wages of individuals directly involved in the production of goods or services.

Q8: If the company pursues the investment opportunity

Q17: The standard labor rate per hour should

Q46: The selling price based on the absorption

Q49: The materials price variance for June is:<br>A)

Q94: Turk's return on investment for the year

Q115: When applying fixed manufacturing overhead to production,the

Q123: The raw materials quantity variance for the

Q124: The materials quantity variance is:<br>A) $1,200 U<br>B)

Q167: If variable manufacturing overhead is applied based

Q205: The standards for product V28 call for