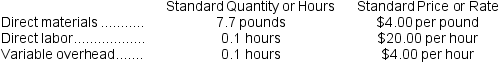

Milar Corporation makes a product with the following standard costs:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor rate variance for January is:

Definitions:

Revised Model Business Corporation Act

An updated framework intended to standardize and guide the law governing corporations in the United States.

Registered Agent

An individual or business entity authorized to accept legal documents on behalf of a corporation or LLC, facilitating legal processes.

Incorporators

Individuals or entities involved in the legal process of forming a corporation, responsible for its initial setup and registration.

Alien Corporation

A business that is incorporated in a foreign country.

Q3: The labor efficiency variance for June is:<br>A)

Q67: A volume variance and budget variance are

Q83: The variable overhead rate variance for July

Q93: When recording the direct labor costs,the Cash

Q97: The following information relates to the direct

Q133: Bungert Inc.reported the following results from last

Q155: A company has a standard cost system

Q180: The variable overhead efficiency variance for the

Q195: The variable overhead rate variance for power

Q303: Herlocker Corporation is a shipping container refurbishment