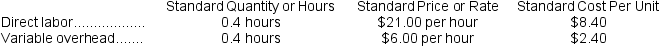

Valera Corporation makes a product with the following standards for labor and variable overhead:

The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.

The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.

-The variable overhead efficiency variance for July is:

Definitions:

Supply Chain

A network of suppliers, manufacturers, and distributors involved in producing, delivering, and selling products.

Marketing Intermediary

refers to businesses or individuals that act as intermediaries within the distribution channel, facilitating the sale of products from producers to end consumers.

Raw Materials

Basic materials that are used in the production process to manufacture goods, often transformed or combined with other materials in the manufacturing process.

Automatic Merchandising

A retailing strategy that involves the use of self-service and vending machines for selling products directly to customers.

Q2: When the direct labor cost is recorded,which

Q3: How much actual Logistics Department cost should

Q7: What was the West Division's minimum required

Q22: The Parts Division of Nydron Corporation makes

Q31: Warp Manufacturing Corporation uses a standard cost

Q58: The labor rate variance for November is:<br>A)

Q67: The division's turnover used to compute ROI

Q102: Assume that the Motor Division is selling

Q120: The volume variance for February is:<br>A) $17,300

Q188: The materials quantity variance for January is:<br>A)