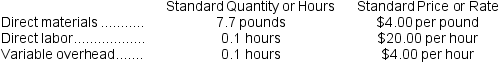

Milar Corporation makes a product with the following standard costs:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor efficiency variance for January is:

Definitions:

Employer Liability

The legal responsibility of employers for injuries, damages, or losses caused by their employees during the course of their employment.

Remedy

Legal solutions or actions used to enforce a right, resolve a dispute, or rectify a wrongdoing or injury, including compensation, restitution, or injunctions.

Family And Medical Leave Act

A U.S. federal law that provides employees with up to 12 weeks of unpaid, job-protected leave per year for certain family and medical reasons.

Family and Medical Leave Act

A United States labor law requiring covered employers to provide employees with job-protected and unpaid leave for qualified medical and family reasons.

Q3: How much actual Logistics Department cost should

Q5: Saulsberry Corporation manufactures numerous products,one of which

Q14: Zanny Electronics Corporation uses a standard cost

Q42: Harris Corporation uses a standard cost system

Q55: Assume that the Valve Division is selling

Q66: The turnover for this year's investment opportunity

Q108: When recording the raw materials used in

Q177: The overhead applied to products during the

Q201: What is the variable overhead rate variance

Q378: Magliacane Corporation is a service company that