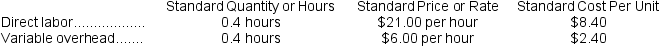

Valera Corporation makes a product with the following standards for labor and variable overhead:

The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.

The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.

-The variable overhead efficiency variance for July is:

Definitions:

Cysts

Fluid-filled sacs that can develop in various parts of the body, often benign and without symptoms.

Pencil-Sized Instruments

Small, slender medical tools designed for precision tasks in surgeries or procedures, often likened to the size of a pencil for their thinness.

Arthroscopy

A minimally invasive surgical procedure used to diagnose and treat joint problems through a small incision using a camera and specialized instruments.

Small Incision

A minimal surgical cut or opening made in the body during operations.

Q40: Leslie Company operates a cafeteria for the

Q41: Kirnon Catering uses two measures of activity,jobs

Q51: Beery Inc.reported the following results from last

Q56: Assume that Division A is presently operating

Q111: Braymiller Inc.has a $1,600,000 investment opportunity with

Q116: If the denominator level of activity is

Q155: The materials price variance for January is:<br>A)

Q163: Sherburne Snow Removal's cost formula for its

Q225: The materials price variance for January is:<br>A)

Q310: Dreckman Corporation is a service company that