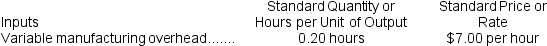

Sade Inc.has provided the following data concerning one of the products in its standard cost system.Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

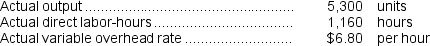

The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December:

Required:

Required:

a.Compute the variable overhead rate variance for December.

b.Compute the variable overhead efficiency variance for December.

Definitions:

Out-of-pocket Cost

Expenses that require immediate cash payment by an individual or company.

Future Outlay

Potential future spending or investments that a company plans to make, which may impact its financial position.

Opportunity Cost

The lost potential gain from other alternatives when one alternative is chosen.

Potential Benefit

The prospective advantage or gain that may be realized from a specific action or decision, often considered in planning and analysis.

Q14: Starcic Products,Inc.,has a Connector Division that manufactures

Q35: What was the variable overhead efficiency variance

Q54: What was the Consumer Products Division's residual

Q59: Assume that the Connector Division is selling

Q63: Chesley Products,Inc.,has a Connector Division that manufactures

Q64: Creger Corporation,which makes landing gears,has provided the

Q83: Leneau Products,Inc.,has a Connector Division that manufactures

Q87: Assume that the Plastics Division is currently

Q114: When recording the raw materials purchases in

Q217: What is the labor rate variance for